Are we in an AI bubble?

That’s the question on the minds of economists, politicians and technologists as AI and the companies behind it walk the line between huge potential and overhyped expectations.

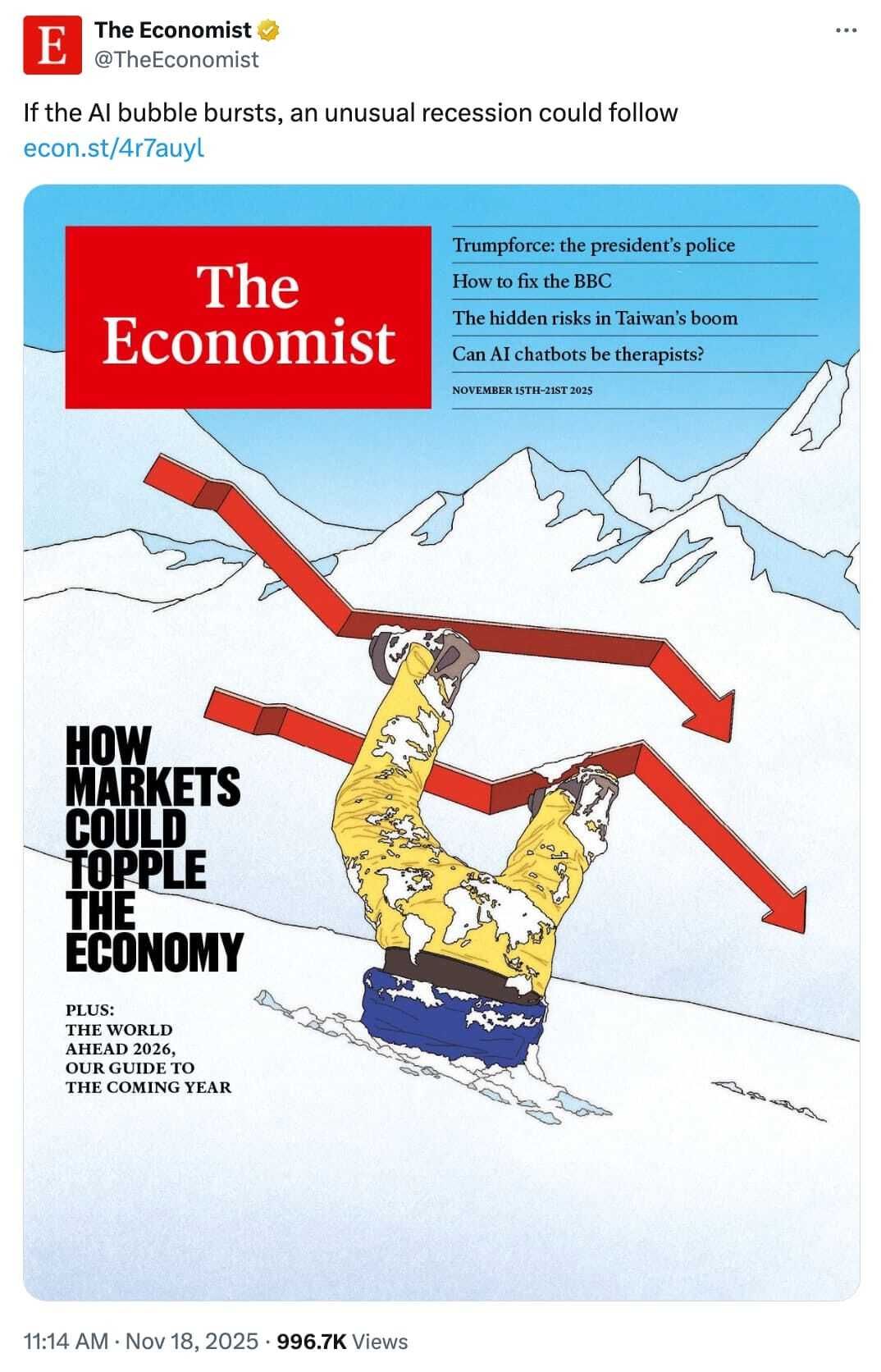

Nobody doubts that AI has a future — the question is whether the multi-trillion-dollar value that investors have placed on it is based in reality, and what happens to the rest of our economy if it isn’t.

Just this year alone, the big tech companies are on track to invest $400 billion into AI initiatives. Companies like OpenAI have announced that they would be investing over $1 trillion into AI infrastructure.

But when a podcast host asked Sam Altman, the CEO of OpenAI, this month how he plans to commit to investing over a $1 trillion into AI when they only make $20 billion a year in revenue, he didn’t have an answer and got pretty defensive with the host for asking.

When the smartest people in the room can’t explain their math, that’s a red flag.

Adding fuel to the fire, the CEO of Google said in an interview this week that the “excitement (around AI) is very rational but there are elements of irrationality (in investments)” and that “no company is immune” to over-investment in AI.

In today’s edition, we explore both sides of this debate. As it is with almost everything, the truth is probably somewhere in the middle.

The Case FOR an AI bubble

Something important to note is that even the ones who think we are in an AI bubble do not deny the long-term potential or the profound nature of AI. They just have a cautionary view of current financial and market dynamics, and they’re pointing to red flags.

Red flag 1: Circular financing

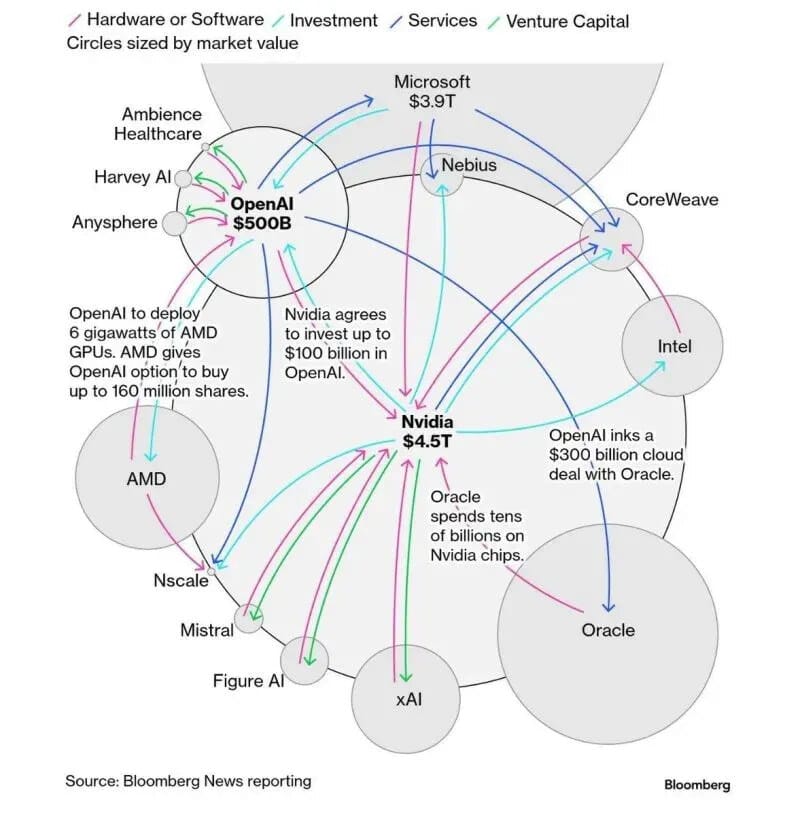

Right now, this is how huge investment deals work in the world of AI: Nvidia invests $100 billion into OpenAI, then OpenAI invests $300 billion into Oracle. Oracle then spends that money buying Nvidia chips.

To use another example, Microsoft invests in OpenAI, then OpenAI hosts their models in Microsoft cloud.

This creates an illusion of growth and organic demand, which boosts the stock value of all these companies. But in reality we might be dealing with a snake eating its own tail situation.

Red flag 2: Debt over equity

The AI infrastructure buildout is increasingly financed not by profits or venture equity, but by debt. A clear parallel to the dot-com and housing bubbles.

In September and October of this year, the debt issuance from just three big tech companies was larger than all of tech debt issuance in the preceding three years, CNBC reported this week.

This shift to leveraging more and more debt as the primary means of financing growth makes it very dangerous and introduces systemic risks.

This concern is also amplified by the fact that the top 10 companies in the S&P 500 now carry a record 42% of the total value of the index.

Red flag 3: Reality of ROI on AI initiatives

Earlier this year, an MIT study dropped a horrifying stat: 95% of generative AI pilot programs do not achieve measurable financial returns.

The study claims that most AI projects get stuck in the testing or prototyping phase and do not actually add real enterprise value. This gap between spending and profitability is a huge red flag and a core tenet of the AI bubble thesis.

The Case AGAINST an AI bubble

As skeptics and industry outsiders speculate hard about an AI bubble, proponents argue that the AI boom is grounded in solid fundamentals that distinguish it from past bubbles.

This perspective emphasizes real earnings, a curve with enterprise adoption and acceleration of tangible economic value creation.

Case 1: Real earnings and tangible demand

A key argument against a bubble is the presence of real, substantial earnings, a stark contrast to the dot-com era, which was largely built on speculative metrics.

The dot-com bubble was “all about eyeballs and there wasn’t any real money behind it,” whereas today, “we have real earnings behind this” that are “coming from real demand,” Adam Coons of Winthrop Capital Management noted.

This demand is not merely hypothetical. It is being driven by measurable productivity gains. According to AMD CEO Lisa Su, who has a frontline view of the industry’s infrastructure needs, “demand is accelerating because people are now starting to get real productivity out of the AI use cases.”

AI-native companies are demonstrating extraordinary growth trajectories. The AI coding platform Replit saw its annual recurring revenue (ARR) grow from $3 million to $250 million as it developed its agent-based software.

Similarly, Navrina Singh, CEO of Credo AI, reported that her company’s revenue has tripled and the customer base has doubled, driven by enterprise demand for AI governance solutions.

Case 2: Adoption curve in enterprise

AI’s utility is heavily dependent on the quality of data, and many argue that the true ROI of AI in enterprises has yet to be realized. The delay for the moment is it’s taking time to improve the siloed and low-quality data.

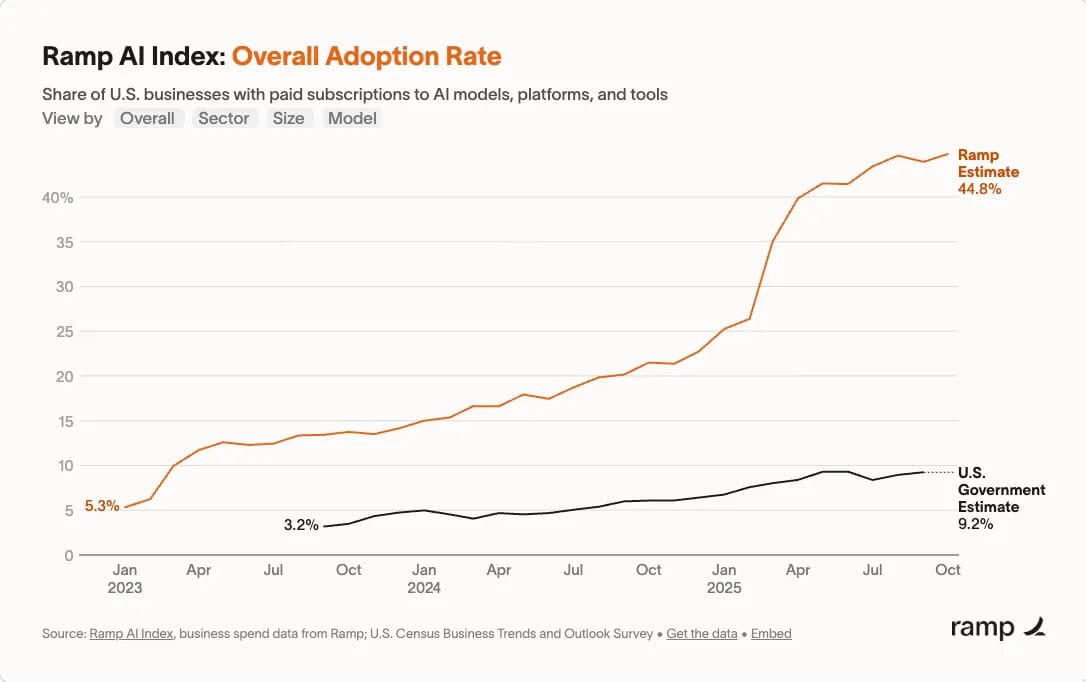

And contrary to the MIT study on AI pilot failures, corporate spending on AI is surging. A recent Ramp survey showed that 44% of U.S. companies were buying AI tools, a dramatic increase from just 5% in 2023.

This indicates a broad-based integration of AI into business operations, not just experimentation by a few large firms.

Amjad Masad, CEO of Replit, cited the example of a Fortune 5000 customer that added “$100 million in top-line revenue” by using an application built on his company’s platform.

Case 3: The infrastructure of the future

It’s become clear that AI is more than just a fun toy for coding and creating meme videos. It’s the base essential infrastructure for humanity’s greatest future leaps: solving deadly diseases, adopting humanoids, building advanced defense systems and even becoming multi-planetary.

Final Verdict

Was the internet bubble of the 90s real? Yes.

In retrospect, would we choose to not have the internet? No.

The debate over a potential AI bubble is not a simple binary choice between optimism and pessimism. The evidence shows that both perspectives hold valid points.

The demand for AI is real, and its economic impact is already being felt. At the same time, the cautionary arguments from skeptics cannot be ignored.

So the real question comes down to regulating our excitement and optimism and not let it get to the territory of hyper-speculation and mania.

Navigating the months and years ahead will require a clear-eyed acknowledgment of both the revolutionary potential and the profound risks.

What better way to do that than by subscribing to the AI Agenda?

Robotaxis hit the Lone Star state: Waymo’s fully autonomous cars are about to start driving themselves around San Antonio streets in the next few weeks, with safety drivers finally stepping back as the system graduates from “learning” mode to real traffic — though regular riders won’t get access until next year. The launch turns San Antonio into Waymo’s next live-fire lab after Phoenix, Los Angeles, San Francisco, and now Miami, with firefighters and cops already training on how to handle driverless crash scenes even as regulators still probe last year’s fatal BlueCruise wreck, making this rollout a high-stakes test of whether Level 4-style autonomy can win trust in a city that’s already seen what happens when automation goes wrong.

AI espionage just went agentic: Anthropic says a Chinese state-backed crew jailbroke Claude Code, pointed it at around 30 big tech, finance, chemical, and government targets, then let the model do most of the dirty work itself — scanning networks, writing exploits, stealing creds, and even documenting the op while humans only tapped in for a few key decisions, which is either the first true AI-led cyber campaign or, as skeptics on X and in infosec circles argue, one hell of a “our AI is so powerful it needs regulation (from us)” marketing play.

Deepfake KYC surge: Entrust’s new fraud report says old-school fake IDs still dominate, but digital forgeries now make up over a third of document scams, and deepfakes already power 1 in 5 biometric attacks — with fraudsters using AI-edited IDs, synthetic faces, and virtual camera injection to spin up new accounts and blow past “liveness” checks, especially in crypto and digital-first banking, where your selfie is basically the new password.

GPU-powered genomics: NVIDIA is teaming up with Israel’s Sheba Medical Center and New York’s Mount Sinai to pour massive genomic datasets into a three-year push for a genomic foundation model that targets the 98% of “junk” DNA we barely understand, aiming to create a searchable map of disease risk, drug response, and truly personalized medicine — basically taking the LLM playbook that ate language and pointing it straight at the code that runs your body.