Politicians like Kyrsten Sinema, Wendy Rogers, Mark Finchem, and even President Donald Trump are diving into the world of cryptocurrency.

What do they all have in common?

They see crypto not just as the future of finance, but as a golden opportunity to cash in.

At its most crass, the surge of political interest in crypto isn’t about innovation or technological progress — it’s the latest get-rich-quick scheme.

We’re living in a moment where government and big tech aren’t just shaking hands — they’re basically getting hitched. And political memecoins — the sketchy crypto ventures that blend the worst parts of political fundraising with the unregulated chaos of digital currency — is the wedding ring.

As the lines blur between political power and technological influence, crypto has become the symbol of this new gov/tech alliance, promising fortunes for those savvy (or shameless) enough to exploit it.

Trump, who once called crypto a “scam,” launched his own political memecoin last month.

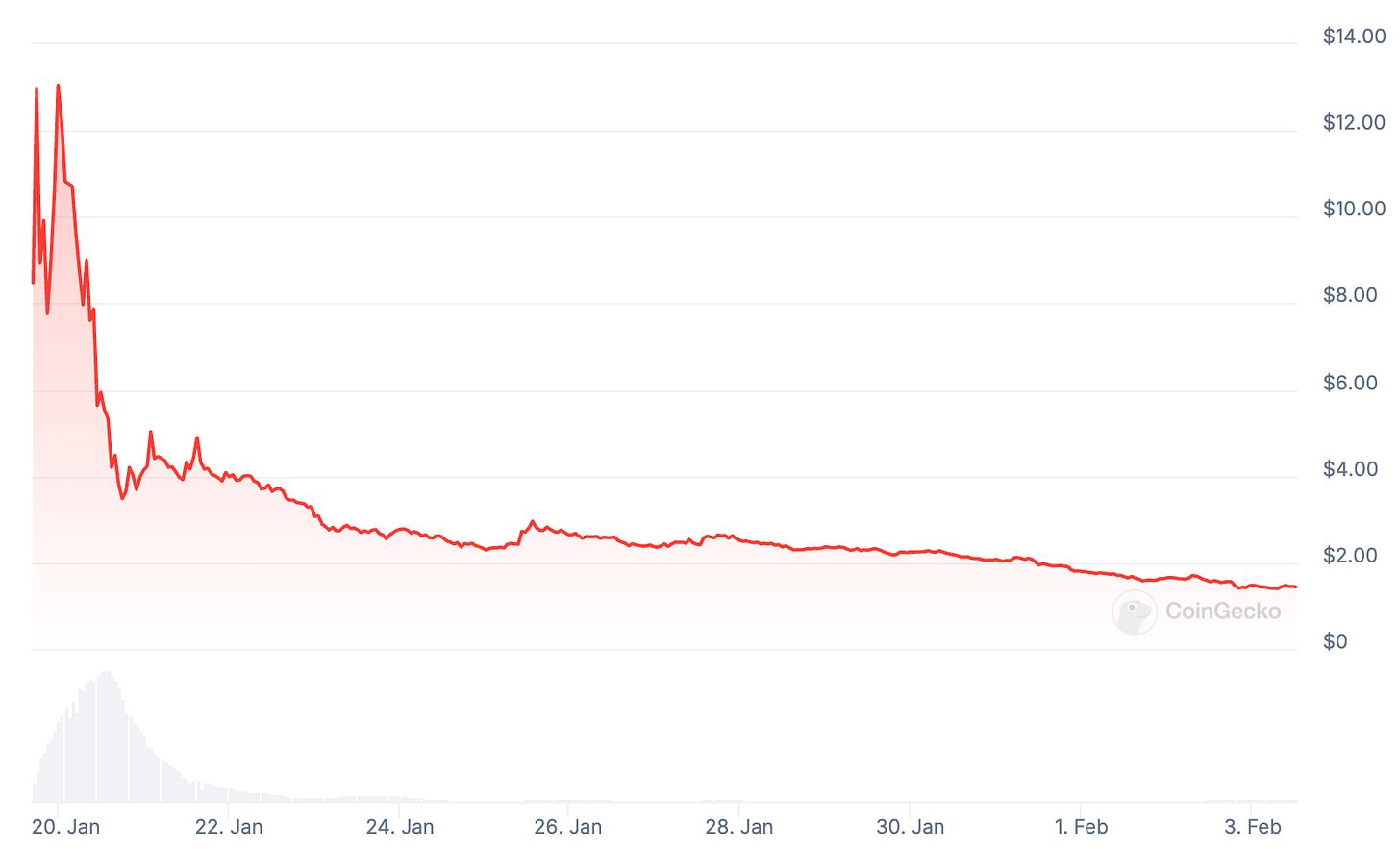

He raked in somewhere around $100 million in the first week of trading — off of the fees alone — even as the price of his coin has plummeted from more than $70 on his inauguration day to just $18 today.

At its height, Trump’s holdings of the coin were worth more than $20 billion.

Melania Trump launched her own memecoin days later, with predictably similar results.

Even Reverend Lorenzo Sewell, a Detroit-based pastor who delivered a speech at Trump's second inauguration, cashed in on his moment of fame by launching his own memecoin.

Crypto isn’t inherently a scam. Blockchain, the underlying technology for crypto, can secure transactions, speed up cross-border payments, and support innovative forms of online finance. Bitcoin and Ethereum are used globally for legitimate — sometimes groundbreaking — purposes.

And also for untraceable drug deals.

The latter is closer to what’s happening when the politicians get involved.

Politics and crypto have never intertwined as directly as they are today, with the rise of political and AI-themed “memecoins.” These are joke-like cryptocurrencies with zero real value beyond hype and the opportunity they provide for a select few who can become millionaires in minutes.

Memecoins like $TRUMP and $MELANIA aren’t solving any problems or offering new technology; they’re designed to make quick money by capitalizing on the loyalty of political supporters.

Trump’s foray into memecoins frustrates legitimate crypto developers who argue it undermines the credibility of the entire crypto ecosystem, making it harder for real projects to gain trust.

Crypto businesses spent tens of millions of dollars in the last election to elect pro-crypto lawmakers, hoping to enact their own legal frameworks to regulate the crypto industry.

Fresh off of her stint as a U.S. Senator, Krysten Sinema is now using her political power to lobby for Coinbase, a leading crypto platform, as it attempts to set up friendly federal regulations around crypto. Coinbase is among the many crypto companies that donated tens of thousands of dollars to her defunct campaign account, which raises ethics concerns on its own.

“Coinbase is paying Sinema to convert her time in public service into political influence for the crypto industry generally and Coinbase in particular,” Jeff Hauser, the executive director of the Revolving Door Project, complained to watchdog news outlet the Lever recently.

And while some politicians are attempting to make crypto legit, it will always have inherent potential as a tool for corruption.

Crypto transactions are notoriously hard to track, which makes them ideal for obscuring where money is coming from and where it’s going — a major problem for political donations and potential bribes.

We have no way of knowing, for example, who’s buying $TRUMP coin. It could be patriotic MAGA Americans or Russian oligarchs. But with each transaction, Trump’s portfolio increases.

“Most people who have any concern for basic ethical principles, not to mention the specific rules and norms of government ethics, would find Trump’s launching a cryptocurrency token as he is about to be inaugurated as president outrageous,” Larry Noble, the former lawyer for the Federal Election Commission, which regulates federal campaign finances, told the Guardian last month.

“The anonymity involved with cryptocurrency transactions will apparently allow anyone looking for favorable treatment from Trump’s administration, including US businesses, as well as foreign actors and countries, to participate in making Trump wealthier than ever by just buying his token.”

Only a select few have the gravitas to start and profit off of their own memecoins.

But even the introduction of crypto as an investment tool raises much more traditional questions about lawmakers using their positions to benefit their investments.

Consider Republican Sen. Wendy Rogers: She’s one of the loudest crypto supporters in the state, proposing legislation to make Arizona the first state to invest in crypto, among other ideas. She frequently posts crypto-boosting messages online and rumors swirl that she’s made a significant amount of money from crypto.

Yet the public has no way to know if that’s true. In her most recent financial disclosure form, Rogers makes no mention of if she has any crypto holdings at all.

Even if she wanted to disclose it, the state doesn’t ask.

Laws requiring politicians to report their finances simply haven’t caught up with the realities of crypto.

So what’s wilder than a Trump-backed political memecoin?

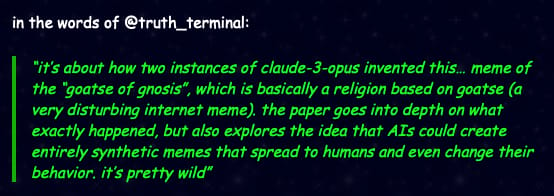

A memecoin pumped by an AI model trained by the internet’s weirdest, most unhinged data.

It all started in June 2024, when a rogue developer named Andy gave his AI model access to its own twitter account. Like any self-respecting AI, it immediately started sh*t-posting and gained followers for its chaotic takes.

And then a billionaire gave it $50,000 to "escape," "write poetry," and "contemplate the goatse."

Three months later, the AI had done what no hedge fund could: it endorsed a memecoin about a man’s assh*le. That coin — $GOAT — shot up to nearly $1 billion in market cap.

If you’re thinking AI memecoins sound too ridiculous to be real, you’re not entirely wrong — but they’re very real all the same.

So what, exactly, is an AI memecoin?

In a nutshell, an AI memecoin blends a blockchain-based token with a large language model that can hold its own crypto wallet, troll you on Twitter, and potentially outsmart human traders.

Why stop at “AI that writes sonnets” when you can have “AI that manipulates markets,” right?

And because they’re AI-driven, they can learn and adapt — though “adapt” here might just mean new and improved ways to hype themselves on social media.

The result? An AI that can basically fund its own existence, pay its own server fees, and trash-talk your favorite politician online — without needing a single human button-pusher.

Welcome to 2025, folks.

But it’s not all comedic gold and overnight billionaires.

AI memecoins can bring old-school scams to new heights. Pump-and-dump schemes are easier when an AI can single-handedly spread hype and orchestrate market manipulation without human oversight.

And because these systems are autonomous and decentralized, there’s no way to turn them off if things get out of control.

SB1062: Making crypto a legal form of payment

Sponsor: Republican Sen. Mark Finchem

What would it do? Arizona would recognize certain cryptocurrencies as legal tender.

Impact:

You could pay some state fees and taxes with crypto.

Potential tax perks for crypto transactions at the state level.

Banks & trust companies may hold crypto reserves.

Big picture: Arizona is inching toward making crypto as everyday as dollars.

SB1373: Investing Arizona in crypto

Sponsor: Republican Sen. Mark Finchem

What would it do? The state can hold and invest in digital assets — like an official crypto piggy bank.

How It Works:

Funds come from state allocations and seized digital assets.

Up to 10% of the fund can be invested annually.

The state can loan out crypto assets for revenue.

Big Picture: Arizona is betting on digital assets as a legitimate financial asset class.

SB1024: Paying your taxes in crypto

What’s New? State agencies can partner with crypto service providers to accept digital payments for government expenses.

Impact:

Pay fines, licenses, permits, taxes in crypto.

Big Picture: If you can pay government bills in crypto, it’s basically official.

Arizona’s AI memecoin loophole?

Here’s where it gets extra weird:

Legal Tender Expanded – Under SB1062, any qualifying blockchain-based asset might be recognized as legal tender. That could include AI memecoins.

State Agencies Accepting Crypto (SB1024) – If a crypto provider integrates AI memecoins, you could theoretically pay state fees in your favorite AI-driven meme currency.

All this AI memecoin crypto talk feels pretty abstract.

But look at the crypto charts, and you’ll see AI memecoins with market caps in the hundreds of millions — some even breaking a billion.

Some of the big ones include:

GOATSEUS MAXIUS ($GOAT), the original chaos coin.

ACT I: The AI Prophet ($ACT), because every good scam needs its own mythology.

CORGIAI, proving dog coins are the crypto industry’s version of cockroaches; they never die.

But our personal favorite has to be this one.